I read a joke that said, “Only humans have to pay to live on this Earth”. This is very true! Humans created this state of affairs, including the concept of private ownership. So, how much exactly does a person need to live in a country like Malaysia? The Malaysian government states it to be a minimum of RM 1,500 per month. This is our current minimum wage that was officialised since May 2022, and the government is required to review it at least once in every 2 years according to The National Wages Consultative Council Act 2011.

After the deduction of voluntary contributions, benefits and taxes, take-home pay might result in RM 1,300 for a working person. 17.3% of that gets spent on food and 5.2% on inflation — which totals about RM 300 per month. That amount for food expenses is arguably not feasible in urban areas. Even if I spend that money on the bare necessities to survive, the minimum required would be RM 15 per day, or 35% (RM 450), from the income. As for the other basic necessities we need such as housing, water and electricity, with 1.2% inflation, another RM 320 is needed. With this budget, you can only afford to rent a small room which is about RM 250. Malaysians need at least RM 700 – RM 1000 per month to rent a 2 bedroom house/flat. Meanwhile, with 3.9% inflation for transport, RM 261 per month is the consumption, at least, according to government data.

Does this accurately reflect our current reality?

All things considered, for most low income jobs, work from home option is not possible, and it does not reflect bank loan repayment for vehicles (car or motorcycle). It is not solely petrol, toll and parking. At least RM 500 is needed for transport every month. My50 ― a government program ― that offers RM 50 for 30 days of unlimited travel on all Rapid Penang and Rapid KL rail & bus services seems to be useful. I was using it for several months. Even then, I still needed additional money for petrol to travel from home to MRT station and car parking, with a total cost of around RM 160 per month. So, how much more is left from the RM 1,500 minimum wage (RM 450 + RM 700 + RM 500)? Absolutely nothing, with a deficit of RM 550!

What happens during that period of time, if one falls sick or needs new clothes? Or if phone bills need to be paid? What about house maintenance repairs that require immediate attendance to, and unforeseen circumstances that occur, such as family emergencies and natural disasters? They would have no choice but to rely on their family members, or to take up loans. More debts with high interests! If someone is unable to provide for oneself, how are they expected to support another person (e.g. elderly mother, their children), with a mere budget of RM 1,500? This directly results in more people having to juggle more than one job.

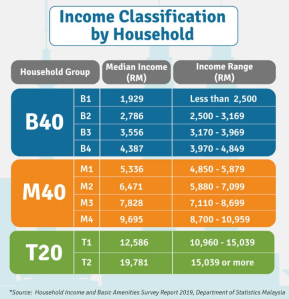

Strong hearsay about B40 has become B60 (income classification). Many households have been pushed from M40 to B40.

[In 2019, the average size of Malaysian households was 3.9 persons].

The gap between the rich and poor is widening. The national budget should redistribute resources effectively to enable the lower-income group so that they can live a decent life with adequate access to basic needs, quality food, and savings for emergencies and old-age retirement. Equally important to note is that workers deserve a balanced lifestyle. Healthier workforce means higher productivity and GDP (the total value of everything – goods and services – produced in our economy).

How will the Budget help the vulnerable?

It goes without saying that the people who are living with financial difficulties want to know how the government budget will reduce their financial burdens, the handling of job creation and how inflation will be controlled. The higher the prices of goods and services, the more we need to fork out money while wages remain the same. Regarding job creation, it is unsure if that is the role of the government or the private sector, since the government is also investing in Business (GLCs), we can assume that they are responsible for creating jobs and conducive environments for 1.15 million SMEs, or 97.2% of total businesses in the country. See: (https://www.smecorp.gov.my).

The government reported (https://www.theedgemarkets.com) that the estimated income for 2023 is RM 285.22 billion. RM 372.3 billion is allocated under Budget 2023. Expenditure is more than income! RM 272.3 billion for operating expenditure, RM 95 billion for development expenditure. Budget 2023 provides RM 55 billion for subsidies, social assistance and incentives. Apparently, allocation for subsidies are reduced compared to the previous year, according to MP Subang, Wong Chan.

- Electricity bill subsidies of up to RM 40 will be provided for households with income of RM 1,169 and below, compared to the present RM 980 and below.

- RM 2,500 for Bantuan Keluarga Malaysia (BKM) — one-off assistance for households with five children or more, with income of less than RM2,500 per month.

- BKM allocation is RM 7.8 billion, to benefit 8.7 million recipients (about RM 900 per household).

- One-off RM 500 cash aid for mothers from Bantuan Keluarga Malaysia households who give birth in 2023.

- Government to bear cost for B40 youths to get access to taxi, bus, e-hailing licenses via MyPSV programme.

- Graduates with first-class bachelor’s degrees exempted from repaying PTPTN loans. It is a good move, but to what extent would it benefit the low income group, assuming that the first class bachelors are mostly people with better opportunities and wealth.

- RM 256 million in monsoon season in assistant to small rubber farmers, to benefit 320,000 small farmers (RM 800 per farmer).

- Supplementary Food Plan rate raised from RM 2.50 to RM 3 in Peninsula, and from RM 3 to RM 4 in Sabah, Sarawak and Labuan – which is a good effort to feed the rural and poor primary school children.

- ‘Bantuan Awal Persekolahan’ aid will be extended to all pupils, irrespective of their parents’ income level (one-off cash assistance RM 150).

- Government to provide RM 700 as special financial assistance to 1.3 million civil servants grade 56 and below, and RM 350 to 1 million govt pensioners next year; these provisions will amount to RM 1.3 billion.

Development projects that would benefit the public:

- RM 1.8 billion allocation for building of new hospitals, clinics and facilities, as well as for procurement of medical equipment. Currently we have 154 government hospitals and 250 private hospitals. With an estimation of RM 150 million per hospital with 130 beds, will the nation have another 10+ government hospitals within the next 5 years?

- RM 700 million allocated for flood mitigation plans – not sure if this is adequate and how soon and effective the mitigations will be. Recently, villagers from one location at Bt. 9 Hulu Langat, affected by the EKVE project, said their village flooded 5 times this year. Damages were done to their property – car, house, household things, road and bridge. They spent RM 15,000 building a bridge with the funds collected among themselves. Not much help was seen from the government and politicians — just promises. There are many other locations in the 13 states with the same issues.

Even though I am not an economist, as a lay person, I can see that the benefits are minimal. The one-off cash assistance, RM 800 – RM 900, for basic needs or to pay any long outstanding debt, is always good. If flood mitigation is done timely, then it will be another relief for many households who are sick with worry whenever the sky is cloudy. For low income families — especially those with young children — increased quality of the supplementary food provided in schools is very good news. Increased number of hospitals and reduced waiting period for critical illness treatment are also important. Taking all this into account, is it fair on me to vote for a government once in every 5 years to only receive these results?

Letchimi Devi

Central Committee

Parti Sosialis Malaysia