PMX DS Anwar Ibrahim’s administration has repeatedly highlighted the need to be prudent in government spending in order to reduce deficits. We are constantly reminded by the Finance Minister that he has inherited more than a trillion dollars of debt from previous administrations that his government has to pay back.

But solutions proposed to increase government revenue have always centred around the call to reintroduce consumption tax, such as the infamous GST or subsidy rationalization. The question we need to ask is: is the government failing to explore other sources of income before harping on the golden goose GST? In this brief essay, I would like to argue that the government ignores the millions of ringgit lost through tax incentives given away to investors both foreign and local to ‘lure’ them to invest in Malaysia. DS Anwar has kept himself busy since taking office, leading many foreign visits to recoup investor confidence to invest in Malaysia. All this in anticipation that it will bring jobs and economic growth to Malaysia. But at what cost?

The Malaysian Investment Development Authority (MIDA) offers a list of direct and indirect tax incentives to lure foreign and local investments. Common incentives are for those investments declared as Pioneer Status (PS) companies. PS Investment enjoys a 70% deduction of their income tax for a period of 5 years. Alternatively, companies can also apply for an investment tax allowance, where they can claim up to 60% of their qualifying capital expenditure within 5 years. Investments that are considered high technology, however, are given a generous 100% tax exemption under the Pioneer Status scheme. (MIDA Policy Booklet, Chapter II)

How much do we lose?

While subsidies provided by the government to cushion the price increase of utilities and food items are often frowned upon as costs, incentives to businesses are looked at positively. But it has the same effect, as it still costs since it is revenue forgone.

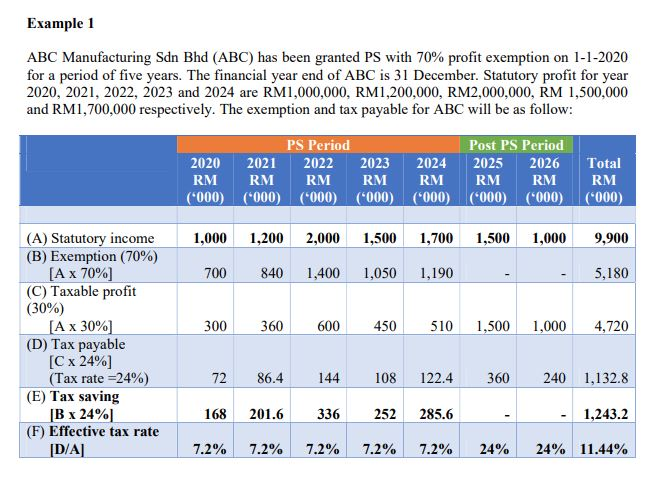

For example, if ABC Manufacturing Sdn Bhd qualifies as a Pioneer Status investment, then 70% of its profits for 5 years are exempt from tax. It only has to pay 24% income tax on 30% of its profits every year. Hence, ABC has saved, or the government has lost, RM 1,243,000 in tax revenue, even though the company was profitable and made a statutory income of RM 9 million in that period. (Chai, 2020)

(Source: TAX INCENTIVES IN MALAYSIA Author: CHAI Meng Ka | 23 April, 2020)

This would work out to a foregone revenue for the government of about RM 248,600 annually. Since concrete data on how many companies actually enjoy tax breaks is scarce, I use as an example a study by UiTM in 2023 (Nasir, Sharifah, 2023) where they used data from the Inland Revenue Board Malaysia. They found that at least 288 companies applied for tax holidays between the years 2017 and 2019. Hence, if we assume that only half applied for PS status, the government has a loss of 288/2 x RM248,000 = RM35,798,400 in revenue every year!

Pioneer status companies enjoying tax breaks is just one of a whole lot of other incentives laid out by MIDA. There are many other incentives for high-tech companies: strategic projects, small-scale companies, special incentives to encourage companies to relocate to Malaysia, reinvestment allowances, and so on.

Sebastian James, in his paper (Sebastian.J., 2014/2020), argues that the impact of giving out tax incentives should be evaluated from a cost perspective. Meaning that the incentives are actually costs to attract investment into Malaysia, tax expenditure should cover all tax incentives as follows:

- exemptions

- allowances

- credit

- rate reliefs

- tax deferrals

- duty exemptions

- VAT exemptions.

When tax incentives are categorised as costs, they should be effectively reflected in the budget presentations so that an accurate assessment can be made if the anticipated returns in terms of jobs and economic growth are commensurate with the costs borne.

Are tax incentives the main driver for investments?

Government policies encouraging investment, both local and foreign, have been in place since the 1950s. The Pioneer Industries (Relief from Income Tax) Ordinance was enacted in 1958, which saw up to 40% tax relief for a period of 3 years for any investment above RM 100,000 and 5 years relief for investments above RM250,000. Pioneer status companies then also had a maximum tax holiday of 8 years if they were located in a government-identified ‘development area’. Other benefits that were given to investment are the export allowance, labour utilisation (local abor), a and location incentives.

As such, MITI should have had the experience and data set to effectively analyse if tax incentives actually served their purpose. An assessment of the actual benefits of these early tax incentive policies by Onn FC and Cheong LK in 1984 (Onn FC, 1984) revealed an unimpressive outcome. They observed that the tax regime of the 1960s and 1970s favoured large over small companies. Thus, it begs the question: are tax incentives only benefiting large, well-established companies? Why do these companies need these tax breaks in the first place?

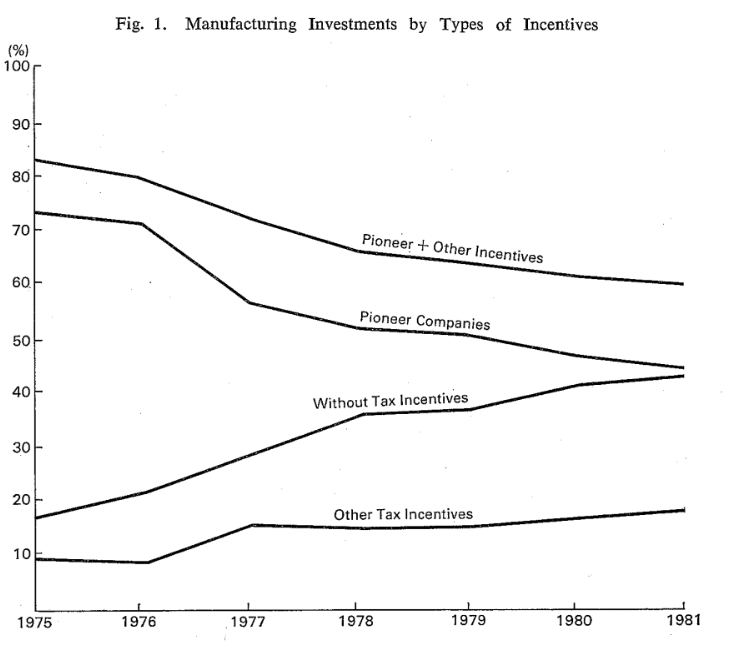

Incentives to attract investment into less developed areas also didn’t bear fruit as expected. Most technology-based turnkey companies completely depended on foreign technology, as there was a clear lack of local tech capability then. While the government believed tax incentives would spur investment, the data tells another story, as illustrated in the graph below.

(Source: Investment Incentives and trends of Manufacturing Investment in Malaysia. The Developing Economics 22(4), pg 396-418, Fong Chan Onn & Cheong LK.1984)

Thus, in their paper, they concluded that tax incentives do not play a major role in driving up investment in some industries. Other factors that do really matter for investors are issues of political stability, infrastructure, transport, and labour.

Hence, why is there a stubbornness within the government, particularly the Ministry of Trade and Investment, to keep tax incentives as a policy action to attract investments?

Especially when the revenue loss through these incentives is framed as a cost for the government. As mentioned earlier, a government that seeks to be prudent in spending needs to seriously look at all measures to save money.

Incentives abused ?

Besides the cost factor, there is an element of abuse of the tax incentives. Saila Naomi (Saila, 2017) analysed data sets from 51 developing countries from 1985 to 2014 and highlighted the possibility of abuse by local companies masquerading as foreign investors to enjoy tax breaks if foreign investors are offered better tax breaks compared to local companies.

Furthermore, as profits are not audited or reported to authorities during tax breaks, it might encourage tax avoidance when enterprises that are not benefiting from tax breaks shift their profits by transferring pricing to companies that enjoy tax holidays.

The data analysis in the paper also revealed that as corporate taxes were spiralling down, instances of nations offering tax holidays increased. Africa, Latin America, Asia, and the Caribbean all saw a decrease in corporate tax rates from 38% in the 1980s to 26% in 2015. But conversely, incidences of tax holidays by developing nations saw a revival after the 2008 financial crisis.

The study finally concludes with the finding that tax incentives are not an effective tool for developing countries as the effect on FDI is small and does not contribute to actual economic growth. Furthermore, the loss in revenue impacts directly on public finances, as it undercuts the ability of the government to spend on public goods for the people. It further suggests that the way forward for developing nations is to phase out policies that offer tax holidays and incentives.

Review and study needed

There is insufficient research and discourse on whether tax incentives really increase investment and if the costs are commensurate with the trickle-down economic benefits expected.

In a report by Dr. Marliza (2021), she found that revenue-positive effects have been gradually suppressed by the reduction of the statutory corporate tax rate (the corporate tax rate was 40% in 1980, reduced to 24% currently) and effective tax rate, partly due to tax incentives. Since 2013 to 2020, the percentage of corporate tax collected from GDP and net FDI from GDP have declined sharply, causing greater stress on government revenue and hence restricting its ability to spend on public goods.

In light of the persistent and concurring findings, MITI has to be transparent and reveal the actual costs of these pro-investment policies and if they are really necessary. Is there a case of incentive redundancy when probably investment would have taken place even without tax incentives?

As a developing country, we need to chart our own path without being indoctrinated by policies that do not benefit us in the long run. The Global South needs to come together to break away from this race to the bottom to reduce corporate tax and keep tax incentives. These policies have only kept us poor, unable to spend on social programmes for our people, and forced governments to borrow further.

Sivarajan A.

Secretary-General

Parti Sosialis Malaysia

March 2024.

References

- Obtaining Investment Incentives and Facilitative Services For Your Business In Malaysia, MIDA Policy Booklet.

- Tax Incentives in Malaysia-: Chai Meng Ka | 23 April, 2020

- Do Tax Incentives Make A Difference? A Case of Malaysian Manufacturing Firms. S. Md Nasir, S. U. L, Mohd Yusof, N. A., & Chuen, L. C. (2023). International Journal of Accounting, Finance and Business (IJAFB), 8(47), 248 – 258.

- Tax and Non Tax Incentives and Investment : Evidence and Policy Implications, , Sebastian James ,June 2014, Updated 2020, Investment Climate Advisory Services of the World Bank Group

- Investment Incentives and trends of Manufacturing Investment in Malaysia.

Onn FC & Cheong LK (1984) The Developing Economics 22(4), pg 396-418

- Rise of Ineffective Incentives : New empirical evidence on tax holidays in developing countries , Saila Naomi Stausholm, (2017), Copenhagen Business School

- Tax Incentives: Tax Revenue vs GDP in Malaysia, Dr Marliza bt Mohammad,(2021) Belt and Road Initiaitive Tax Journal ,Vol2, No.2.